Tractor Insurance Cost: Finding the Best Deal

Protecting your compact tractor is essential, but navigating insurance options can be confusing. This guide simplifies the process, helping you find affordable and effective coverage. We’ll compare key providers like Progressive and USAA, and provide actionable steps to secure the best deal. Are you ready to save money on your tractor insurance? Let's begin! For more on vintage tractors, see this link to vintage tractors.

Factors Affecting Tractor Insurance Costs

Several factors influence the cost of your tractor insurance. Understanding these helps you make informed decisions. Did you know that even the location of your tractor can significantly impact your premium?

Tractor Value: Newer, more expensive tractors naturally cost more to insure. Older tractors typically have lower premiums.

Coverage Level: Basic liability coverage (protecting others in case of an accident you cause) is cheaper than comprehensive coverage (which also protects your tractor from damage, theft, and breakdowns).

Deductible: A higher deductible (the amount you pay before insurance coverage begins) lowers your premium, but increases your out-of-pocket expenses if you file a claim. What deductible level best suits your financial situation?

Location: Rural areas may have higher rates due to increased risk factors.

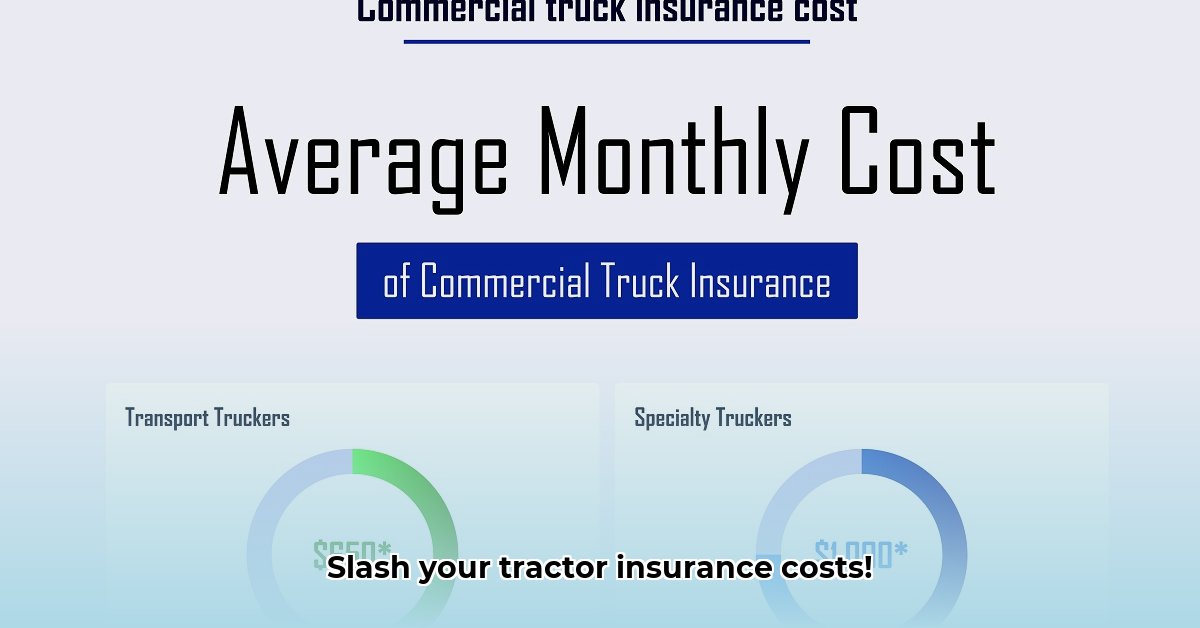

Usage: Commercial use typically results in higher premiums than personal use.

Tractor Age: Older tractors might have limited coverage options available.

Choosing the right balance between cost and coverage is critical. This depends on your tractor's age and condition, how frequently you use it, and the potential risks involved.

Progressive vs. USAA: A Comparative Analysis

Progressive and USAA are leading insurance providers, but their offerings differ. We’ve compiled a comparison to help you make an informed choice. Remember, these are general observations; your actual rates will depend on your specific circumstances and needs.

| Feature | Progressive | USAA |

|---|---|---|

| Typical Starting Price | Generally lower for basic liability coverage. | Potentially higher, particularly for comprehensive coverage. |

| Maximum Coverage Amounts | Check their website for details. | Potentially higher limits available. |

| Coverage for Accessories | Included, but limits may apply. | Clarification needed; contact directly. |

| Tractor Replacement Cost | Consult policy documents. | May offer replacement cost coverage for newer tractors. |

| Eligibility Requirements | Restrictions may apply to age and commercial use. | Varies by state and specific policy. |

This comparison highlights typical differences. It’s vital to obtain personalized quotes from both companies for an accurate assessment. Your individual needs significantly impact the final cost. Do you prioritize lower premiums or more comprehensive coverage?

Seven Steps to Lower Your Tractor Insurance Costs

Saving money doesn't necessitate sacrificing crucial protection. Follow these proven steps:

Compare Quotes: Obtain quotes from multiple insurers; don't settle for the first offer.

Assess Coverage Needs: Choose a coverage level appropriate for your tractor's value and usage. Avoid over-insuring.

Adjust Deductible: A slightly higher deductible can significantly reduce premiums. Weigh the trade-off between lower premiums and potential out-of-pocket expenses.

Explore Bundling: Bundle tractor insurance with other policies (homeowner's or auto) for potential discounts.

Enhance Security: Store your tractor securely (locked shed or garage) and consider anti-theft devices.

Maintain Your Tractor: Regular maintenance reduces the risk of breakdowns and potentially lowers your premiums over time.

Review Annually: Re-evaluate your coverage annually to ensure it aligns with your changing needs.

Hidden Costs and Important Questions to Ask

Before committing to a policy, ask your insurer these questions:

- Pre-existing Damage: Does pre-existing damage affect coverage or premiums?

- Policy Exclusions: Are there specific scenarios or damage types excluded from coverage?

- Bundling Discounts: Inquire about any potential savings from bundling policies.

By understanding the factors influencing costs, comparing quotes diligently, and employing these strategies, you can secure affordable and comprehensive protection for your valuable equipment. Don’t delay – compare quotes today!

How to Compare Compact Tractor Insurance Quotes from Progressive and USAA

Key Takeaways:

- Progressive and USAA cater to different needs. Progressive often offers broader coverage and discounts, while USAA might focus on personal use and high-value equipment replacement.

- Location, coverage levels, and deductibles significantly impact premiums.

- Older or commercially used tractors may face coverage limitations with both providers.

- Carefully consider your needs before selecting a provider. Always obtain quotes from both for a fair comparison.

Comparing quotes from Progressive and USAA needn't be daunting. This step-by-step guide simplifies the process.

Understanding Your Needs

First, assess your requirements. Is your tractor used primarily for personal or commercial purposes? What accessories do you have? These factors influence coverage options and premiums. How much coverage is truly necessary for your specific situation?

Comparing Progressive and USAA Coverage

Both providers offer liability and comprehensive coverage, but the details differ. This table illustrates key differences based on general market observations. Always verify specifics directly with each provider.

| Feature | Progressive | USAA |

|---|---|---|

| Liability Coverage | Starting at $75/year (likely lower limits) | Starting at $300/year (likely higher limits) |

| Replacement Cost | Details less explicitly defined | Available for newer tractors (check specifics) |

| Accessory Coverage | Up to $30,000 mentioned | Less specific details |

| Deductible Options | Not explicitly detailed | Tiered structure ($250, $500, $1000, $2500) |

| Tractor Age Limits | May exclude older tractors | Less restrictive age limits (likely) |

| Commercial Use | May require a separate policy | May require a separate policy for commercial use |

Step-by-Step Guide to Comparing Quotes

Gather Information: Note your tractor's make, model, year, usage (personal or commercial), and accessories.

Obtain Quotes: Use the online quote tools on the Progressive and USAA websites, providing accurate information. Contact customer support if needed.

Analyze Carefully: Compare policies side-by-side. Consider coverage limits, deductibles, and exclusions. Don't just focus on the price; ensure adequate coverage.

Ensure Fair Comparison: Compare policies with similar coverage levels. Adjust deductibles for a fair assessment.

Make Your Decision: Choose the policy that best meets your budget and risk tolerance while providing adequate protection.

Additional Considerations

Geographic location impacts your premium. Rural areas may have higher rates due to increased risk. Contact both providers for a personalized quote that reflects your specific situation and location.